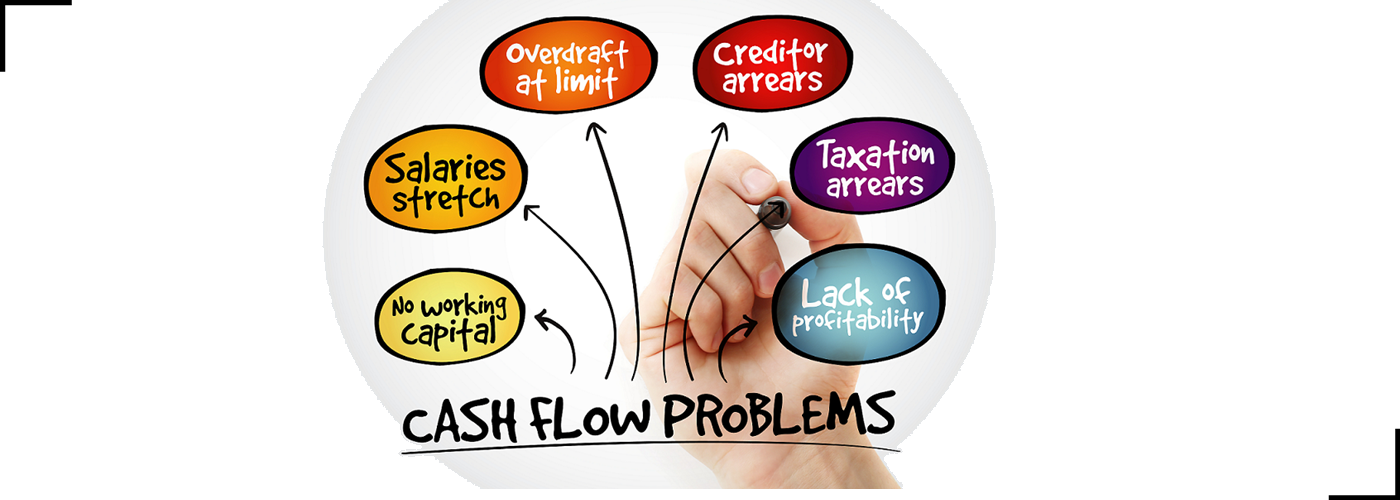

Cash Flow Management

The simplest way to define cash flow is the movement of money in or out of the business during a pre-specified time. Maintaining and updating cash flows is crucial for the business to understand its liquidity as well as take sound financial decisions.

IFRS Guidelines for preparation of Cash flow Statements

According to International Financial Reporting Standards (IFRS), the movement of all cash and cash equivalent statements should be included in a firm’s cash flow statement. This means that along with cash on hand, a business needs to include demand deposits, short term liquid investments that could be easily converted to cash, as well as overdrawn bank balances. Any movement in borrowings or net debts need not be shown in the cash flow statements.

IFRS states that the cash flow statement should be consistently prepared either using direct method (i.e. Based on cash receipts and payments) or indirect method (i.e. wherein profit or loss is adjusted for the effect of non-cash adjustments).

Benefit of Preparing Cash Flow Statement

While preparing a cash flow statement the major goal for a business is to enhance the use of funds. Cash flows help a business to speed up collections, avoid unnecessary and early disbursements and to minimize idle balances.

Another major advantage of preparing cash flow statement is minimizing operational cost. Cash flows to also aid in routinizing the cash flow process and minimizing the time and involvement of the company’s management into routine, mundane process.

Financial Plans and Cash Flow

A financial consultant can help you in devising a private business plan for your organizations and the structure of the economic model for your business. You can get your business plan ready within five days. We guarantee delivery date for the business plan along with an assurance of quality.

Working capital Management:

We help outsourced financial services inaccurate forecast of your budgets and forecasting your working capital needs. At AnKaa we assist you in optimizing the cost of working capital and maintain inefficient use of your resources.

Credit Management:

At AnKaa we help you in managing your credit and reducing the cost of credit. We can advise on devising a credit structure for your business.

We will be glad to assist you! Contact Us Here!

IFRS Guidelines for preparation of Cash flow Statements

According to International Financial Reporting Standards (IFRS), the movement of all cash and cash equivalent statements should be included in a firm’s cash flow statement. This means that along with cash on hand, a business needs to include demand deposits, short term liquid investments that could be easily converted to cash, as well as overdrawn bank balances. Any movement in borrowings or net debts need not be shown in the cash flow statements.

IFRS states that the cash flow statement should be consistently prepared either using direct method (i.e. Based on cash receipts and payments) or indirect method (i.e. wherein profit or loss is adjusted for the effect of non-cash adjustments).

Benefit of Preparing Cash Flow Statement

While preparing a cash flow statement the major goal for a business is to enhance the use of funds. Cash flows help a business to speed up collections, avoid unnecessary and early disbursements and to minimize idle balances.

Another major advantage of preparing cash flow statement is minimizing operational cost. Cash flows to also aid in routinizing the cash flow process and minimizing the time and involvement of the company’s management into routine, mundane process.

Financial Plans and Cash Flow

A financial consultant can help you in devising a private business plan for your organizations and the structure of the economic model for your business. You can get your business plan ready within five days. We guarantee delivery date for the business plan along with an assurance of quality.

Working capital Management:

We help outsourced financial services inaccurate forecast of your budgets and forecasting your working capital needs. At AnKaa we assist you in optimizing the cost of working capital and maintain inefficient use of your resources.

Credit Management:

At AnKaa we help you in managing your credit and reducing the cost of credit. We can advise on devising a credit structure for your business.

We will be glad to assist you! Contact Us Here!